Our Resources

Filter By

-

Managing for Performance: reducing energy intensity at Edinburgh House

12 March 2024

Around 30% of the UK’s total energy-use goes to heating and powering buildings. Managing this energy effectively is critical to achieving Net Zero goals in the built environment. Situated in Kennington, London, Workspace’s Edinburgh House provides a modern, high quality and flexible work space for 78 small and medium sized businesses. Last year, an unusually high energy intensity was detected at the site. As a BBP Climate Commitment signatory and an organisation committed to achieving Net Zero carbon by 2030, this prompted investigation and the implementation of cost-effective measures to drive the energy consumption down. These measures included tenant engagement and optimising controls within the building.

Topic: Energy/Carbon

Type: Case Studies

Member: Workspace Group

-

Derwent London Achieves Net Zero Success at 80 Charlotte Street

16 February 2024

80 Charlotte Street is Derwent London’s first net zero carbon development and one of the largest all-electric schemes in London. It is heated and cooled using air source heat pumps and powered by renewable electricity from certified sources – significantly reducing emissions compared to traditional gas boilers. More than a year after the first occupiers moved in, there have been zero hot and cold complaints, reflecting the huge success of the building’s low carbon heating and cooling systems, combined with high performance fabric.

Topic: Energy/Carbon

Type: Case Studies

Member: Derwent London plc

-

LaSalle develops TRI, Munich’s first timber office building

28 February 2023

LaSalle Investment Management (LaSalle) and Accumulata Real Estate Group (Accumulata) are developing Munich’s first hybrid timber office building, TRI.

Topic: Energy/Carbon

Type: Case Studies

Member: LaSalle Investment Management

-

Brookfield Properties upgrades 1930s building to 21st century standards

14 February 2023

At The Gilbert in London, Brookfield Properties has brought energy performance up to modern standards while retaining 90% of the original structure

Topic: Energy/Carbon

Type: Case Studies

Member: Brookfield Properties

-

Royal London Asset Management launches fully electric hotel and minimises whole life carbon

06 February 2023

The Leonardo Royal Hotel in Bristol is Royal London Asset Management’s first fully electric hotel, with all heating, cooling and hot water provided by air source heat pumps and mains electricity. A whole life carbon study in line with the UK Green Building Council (UKGBC) Advancing Net Zero guidance evidences that the project outperforms best practice standards for both embodied and operational carbon. All space has been designed for the wellbeing of guests and staff.

Topic: Energy/Carbon

Type: Case Studies

Member: Royal London Asset Management

-

abrdn pioneers nature-based solutions in the UK

14 December 2022

The abrdn Property Income Trust (aPIT), one of abrdn’s real assets investment strategies, has launched one of the largest native woodland and peatland restoration projects in the UK, at Far Ralia Estate in Scotland’s Cairngorms National Park. This pioneering project will maximise environmental and social co-benefits, alongside climate impact. The land extends across more than 1,400 hectares – the size of nearly 2,000 football pitches. Works will include planting at least 1.5 million trees, focusing on native species such as Scots Pine, Oak and Birch.

Topic: Energy/Carbon

Type: Case Studies

Member: abrdn

-

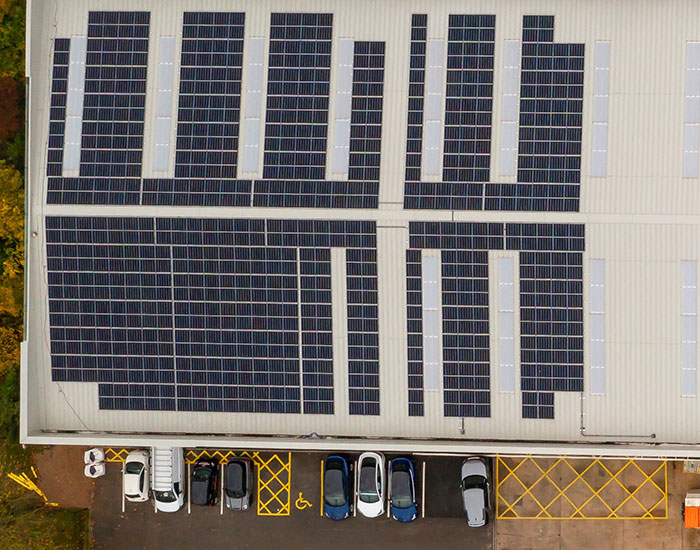

Orchard Street Investment Management Transforms Energy Performance Across Industrial Portfolio

12 July 2022

Improving existing building stock is critical to delivering a net zero carbon future for the UK. To accelerate progress towards a net zero portfolio, Orchard Street Investment Management has successfully upgraded an additional 35 industrial units to Energy Performance Certificate (EPC) ratings of B or above, largely through refurbishment, in just two and a half years. Nine units achieved the highest rating A+, predicted to be operationally carbon neutral for regulated building energy. Plans are in place for remaining assets lower than EPC D to be raised to B or above.

Topic: Energy/Carbon

Type: Case Studies

-

GPE Accelerates Progress to Net Zero Through Industry-Leading Internal Carbon Price

12 January 2022

GPE’s internal carbon price of £95 per tonne, which originally launched in 2020, is transforming behaviour and driving innovation in the race to net zero. Covering both embodied carbon and operational emissions, this internal carbon price goes further than others in the UK real estate sector. All contributions feed into a Decarbonisation Fund, created to support the deep retrofitting of the existing portfolio, further accelerating the transition to net zero and building in climate resilience for the future of London.

Topic: Energy/Carbon

Type: Case Studies

Member: GPE