What do you think of when you hear the words ‘sustainability’ or ‘being green’? Does it conjure images of long-haired hippy-types wearing brown sandals and hugging trees? Saving polar bears? Or recycling Coke cans and yoghurt pots? Environmental issues are often misunderstood and seen as someone else’s problem. Worse, they are even ignored and considered to be irrelevant to modern business.

The reality couldn’t be further from the truth: consideration of environmental, social and governance (ESG) issues is now a key part of modern property management and makes good business sense.

ESG in action

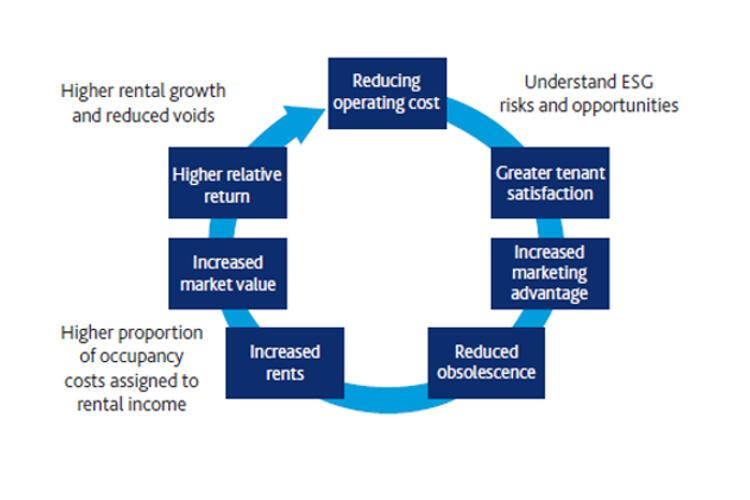

But what do we mean by environmental, social and governance when it comes to property investing? In essence, it is recognising that our investment activities can have a direct and indirect impact on the environment and on society. This can present risks as well as opportunities for improvement. And it is our job to identify and manage these issues in order to futureproof our clients’ investments and to maintain income.

In practice, this involves a wide range of activities, such as improving energy efficiency and water usage, dealing with ground contamination issues or flood control, and even facilitating transport links and electric vehicle facilities near our buildings. The building fabric and the welfare of those who occupy our buildings are other important considerations. As a tangible asset, property is at a greater risk from changing environments and rising costs than other asset classes. And it’s our responsibility to manage those environmental and social implications appropriately.

But as well as being good for the environment, a rigorous ESG approach also makes properties more modern and efficient – which makes them more attractive to tenants. As a result, an effective ESG strategy can reduce portfolio risks, secure higher rental growth from our properties and reduce voids within our property portfolios. It’s a win-win situation for our investors and tenants, and for the environment.

Our strategy is founded on four key commitments: strategic risk and resource management, where we identify, assess and monitor risks; governance and compliance, where we respond to and comply with regulatory requirements in different countries; industry leadership, which involves sharing our knowledge and engaging with governments; and, finally, working in partnership with our investors, tenants, suppliers and the communities we serve.

Case study one: sunlight doesn’t just make vitamin D

An example of a successful ESG policy in practice is a large solar panel development project we recently completed on one of our UK properties. The 16,720 square metre industrial property in Edmonton, north-east London, is occupied by Biffa Waste Services. It is the company’s key waste recycling plant in London and its lease has a further 20 years left to run.

The project involved installing 1,000 solar panels, with the aim of providing around 225,000 kilowatt hours of electricity each year and reducing carbon dioxide emissions by around 120 tonnes a year – the equivalent of heating water for 11.2 million cups of tea every year. This project is also expected to create £280,000 of savings for our tenant over the next two decades, while generating £575,000 of net profit for us as landlords over the same period.

Case study two: no swanning around with shopping park sustainability

The Two Rivers shopping park in Staines is another example where we’ve worked with tenants to successfully implement sustainable initiatives. This 35,300 square metre scheme consists of prime retail and leisure facilities and is owned jointly by Aberdeen Asset Management and M&G Real Estate.

Working alongside the onsite property management team, we introduced a range of measures to increase recycling, reduce waste to landfill, and reduce carbon dioxide emissions as a result of fewer waste collections. The biodiversity and appearance of the nearby riverbank has also been improved where a pair of breeding swans build their nests each year. Other developments include more green areas around the shopping centre and green travel options: the park is easily accessible by bus, train and bicycle, and there are electric charging points for cars. Energy-saving initiatives include a phased LED light programme and sleep modes on car park facilities. These initiatives have reduced the park’s carbon dioxide emissions by 90% and the park now has zero waste going to landfill, reducing the park’s landfill tax by £26,000 a year. These savings come directly from the tenants’ running costs, which makes the centre more attractive in the longer term. And, happily, the breeding swans are clearly content with their improved riverbank, returning every year. This is a point of interest for both customers and the local community, and it increases the retail footfall at the same time.

The benefits of having an effective sustainable policy for our properties and the environment are numerous. This is not a “nice-to-have” policy; rather it’s a critical element of day-to-day asset management. It’s a vital component for keeping our properties modern, efficient, profitable and attractive to tenants. Aberdeen Asset Management may be remote from the lazy stereotype of the brown-sandaled tree hugger, but environmental considerations are nonetheless key to our investment thinking.

This article was originally published on the Aberdeen Asset Management website here.