Aviva Investors – Proactive Engagement with Investors on ESG

26 January 2018Aviva Investors – Proactive Engagement with Investors on ESG

26 January 2018In 2016, Aviva Investors introduced quarterly reports on environmental, social and governance (ESG) matters for all funds. Alongside GRESB ratings, these communicate to investors the ESG performance of each fund, and demonstrate Aviva Investors’ proactive and forward-looking approach to ESG risks and opportunities. The whole process has also increased collaboration throughout the business on ESG.

Key Facts

- Ten 2017 GRESB Green Stars

- Quarterly ESG reports for investors

- ESG included in fund presentations

Situation

For Aviva Investors, a key component of being a responsible business is ensuring that ESG matters are considered throughout the investment process. Aviva Investors has seen growing investor interest in ESG, both through direct engagement and through initiatives such as the Principles for Responsible Investment (PRI) and Global Real Estate Sustainability Benchmark (GRESB). In 2016, Aviva Investors introduced quarterly ESG reports for all funds, supported by sustainability consultant Carbon Credentials.

Actions

Each quarterly report covers performance against waste, water and energy targets. Additional topics are rotated to keep content relevant and fresh for investors. Recent examples include climate change resilience, Minimum Energy Efficiency Standards (MEES) and GRESB survey results. Fund managers are incorporating information on ESG into slides in fund decks used to engage with investors, extracting data from the quarterly reports. Fund managers agreed to this as part of a best practice approach to transparency around ESG for investors.

Climate change resilience

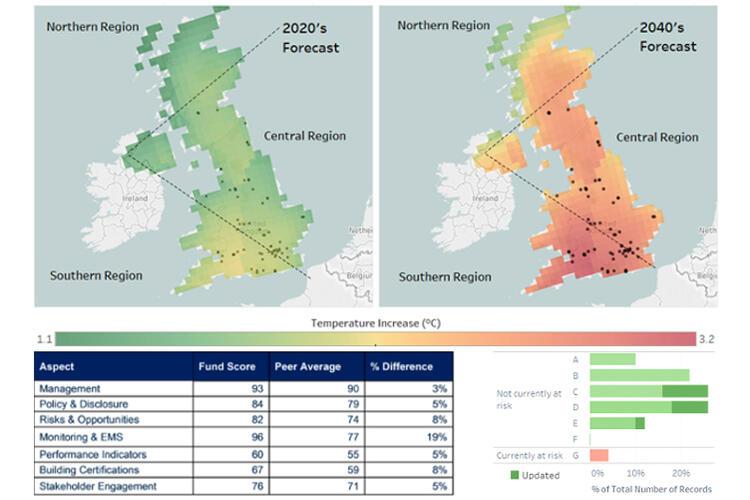

Aviva Investors and Carbon Credentials analysed forecast mean maximum temperature increases for the summer in the 2020s and 2040s. The graphic below shows regional results, at a 25km2 resolution, with the black dots representing properties within one of Aviva Investors’ funds. This modelling highlighted up to a 3.2⁰C average increase for assets in the south, which could have a significant impact on how assets are managed long-term.

Through the RPI programme, Aviva Investors is now looking in more detail at:

- Older buildings and buildings with low Energy Performance Certificates (EPC), which are at risk of greater inefficiencies in equipment and building fabric.

- The development and procurement process, to incorporate future temperature modelling.

- Opportunities to upgrade plant equipment and to regularly review heating and cooling resilience.

MEES

The incoming MEES legislation makes it unlawful for landlords to grant a new lease for properties/units that have an Energy Performance Certificate (EPC) rating below E, from 1 April 2018, with few exceptions. This presents an important compliance and revenue risk to funds.

Aviva Investors is proactively ensuring that all assets have an E or above rating before the 2018 deadline, which also has a positive impact on asset efficiency. The graphic below shows the breakdown of property/unit EPC risks for one fund. The dark green indicates the update in EPCs versus the previous quarter, which increased the number of ‘not at risk’ properties/units.

GRESB

Aviva Investors recognises the value of GRESB in showing investors how proactive an organisation is to ESG issues. Rather than viewing GRESB as a one-off reporting exercise, Aviva Investors carries out a gap analysis of results to understand how scores can be improved by implementing value-add recommendations.

Aviva Investors has improved from two to ten Green Stars in two years. This has been achieved both through a new Environmental Management System (EMS) that has improved data collection and reporting, and through energy efficiency and other initiatives. The graphic below shows GRESB scores versus peer average for one fund.

Benefits

The quarterly reports demonstrate to investors the quality of Aviva Investors’ RPI strategy and performance, and how it is proactive and forward-looking in its approach to ESG risks and opportunities.

The whole process has increased collaboration on ESG issues within Aviva Investors. This includes:

- Questions from fund managers about topics covered and different areas of ESG.

- Positive feedback on assets profiled, from the fund manager to the managing agent and building team.

- Greater input from across the business around the direction of the RPI programme, including at the quarterly Responsible Property Investment Committee, which is attended by members of teams across the business.

This increased focus on ESG will contribute to the overall performance of funds over time. For instance, through:

- Financial savings are expected through reduced energy costs and maintenance spend.

- Efficiency and wellbeing initiatives, which can be used to market space to occupiers and increase occupier satisfaction, ultimately impacting on voids and enhancing the profit and loss statement.

- Improved GRESB scores, which can be used by funds for marketing to investors.

- Proactive approach to ESG risks and opportunities, such as MEES, climate change resilience and science based targets.

Challenges and Achievements

COMMUNICATION

How to engage with investors on ESG?

Aviva Investors and Carbon Credentials focus on communicating ESG in a way that is relevant for investors, aligned to their interests and goals. Fund managers take the conversation to investors using the quarterly reports. These not only communicate Aviva Investors’ PRI strategy and set out the ESG performance of each fund, but also emphasise the commercial benefits of ESG initiatives, such as mitigating regulatory risks through efficiency programmes and enhancing the marketability of assets to occupiers through BREEAM ratings. Quarterly reports that make a strong commercial case have proven to be effective, increasing ESG awareness and dialogue both with investors and within the business. The team continues to explore additional opportunities to engage with investors on ESG.

Find out more

Michael Borello

Fund Manager

Aviva Investors

Email: michael.borello@avivainvestors.com

Tel: 020 7809 6000

Oliver Light

Senior Consultant

Carbon Credentials

Email: oliver.light@carboncredentials.com

Tel: 0203 053 6652

*Please note that the information on this page was supplied by the BBP Member and the BBP assumes no responsibility or liability for any errors or omissions in the content