Sustainability Bites? The Impact of Minimum Energy Efficiency Standards for Commercial Real Estate Lending

05 November 2015Sustainability Bites? The Impact of Minimum Energy Efficiency Standards for Commercial Real Estate Lending

05 November 2015In recent years sustainability risks and drivers have had a transformational impact on the way in which equity investors approach direct real estate investment and management.

One of the greatest drivers we’re now seeing in the UK is the introduction of regulatory Minimum Energy Efficiency Standards (MEES). Major REITs and fund managers are starting to get to grips with the impacts these regulations will have on the property portfolios they own – particularly well highlighted by this Aberdeen Asset Management case study. However, with many institutional and private equity investors increasingly focused on lending as an additional form of real estate exposure, the impacts of these regulations as well as wider sustainability considerations need to be considered from a new angle.

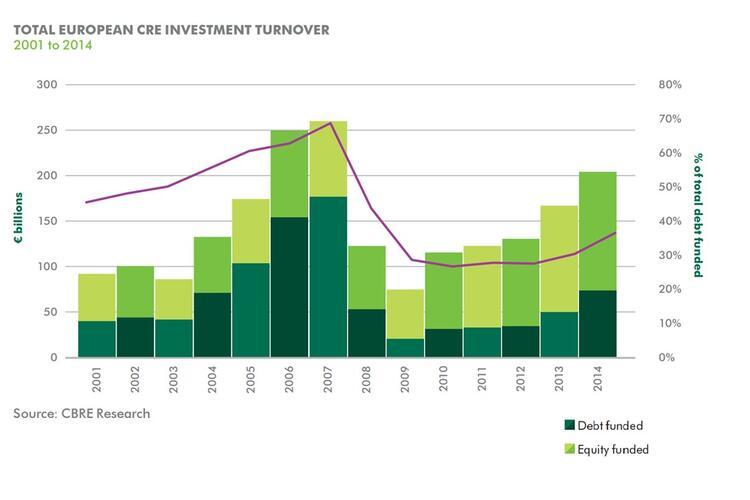

This is particularly important given the way the real estate lending market has been evolving since the 2008 financial crisis. To begin with, lending activity has recovered strongly in the last year or two in the UK and much of Europe and now represents one third of the total commercial real estate investment market. While levels remain well below previous cycle peaks (CBRE estimate 2014 absolute levels are still less than half of their 2007 peak) 2014 saw a 55% increase in lending origination across Europe and 45% of that secured on properties in the UK1.

Secondly, we’ve witnessed a shift in the type of lender from the more traditional lender (i.e. banks) to an influx of new institutional lenders. De Montfort University’s Commercial Property Lending Report suggests that around a quarter of new lending is coming from insurance firms (and their investment management arms) and other non-bank lenders (such as private equity debt funds).

Now for commercial real estate lenders, whilst they are one step removed from the risks that typically affect their borrowers and those that directly invest in property, Minimum Energy Efficiency Standards still pose a significant new risk. Indeed, any property securing a loan that falls below this minimum standard may potentially be subject to:

- A negative impact on collateral value and as a result a consequential increase in the loan to value ratio (perhaps threatening financial covenants);

- Increased void rates, impacting the ability of the borrower to pay back the loan;

- Additional capital expenditure to raise the property above the minimum standard.

With these banks and non-bank lenders ramping up their exposure secured against commercial real estate it is questioned how aware are they of the potential implications Minimum Energy Efficiency Standards pose and incorporating the appropriate risk management strategies?

To support the commercial real estate lending community, with the help of our Real Estate Lending Working Group, we have put together an Industry Insight which highlights the risks associated with Minimum Energy Efficiency Standards and the practical steps lenders can take to mitigate such risks.

The paper sets out how a lender can reduce its risk exposure for:

- New lending decisions: through due diligence, underwriting and loan documentation; and

- Existing loan books: through loan book monitoring and borrower engagement.

In addition, it touches on some of the wider sustainability considerations lenders may wish to take into account as part of their risk management strategies and helps lenders understand the opportunities of going beyond risk management. Whether this is through proactive engagement strategies with their borrowers, or the development of new products and business models that can unlock new sources of capital whilst simultaneously contributing to a more sustainable built environment.

This concept of ‘beyond risk management’ is the next topic our Working Group will focus on and we’re looking for examples of where lenders are ramping up activity in this area, such as Fannie Mae’s multi-family green financing loan. If any lenders are interested in discussing how we can progress this concept further into mainstream lending activities please do get in touch!