GN 1.4: The wider risk context

Guidance Note purpose

The purpose of this Guidance Note is to provide asset managers, property managers and facilities managers with information about understanding and defining the wider environmental risk context associated with a property of portfolio.

Context

The wider context of a company includes internal and external issues that have the potential to prevent or assist a company in achieving its intended business outcomes. This includes environment related factors that may affect, or be affected by, the company.

These factors are typically organised into the following categories:

- Political.

- Economic.

- Social.

- Technological.

- Legal.

- Environmental.

The potential positive and negative effects of these factors provide a source for the identification of environmental risks. The wider context is usually considered at the level of the company and portfolio.

Importance

Understanding risks relating to a company’s wider context is an important part of property management.

Commercial real estate involves the long-term investment in assets of significant value which have the potential to be affected by a wide range of factors in the short, medium and longer term.

Identifying and evaluating risk relating to the wide context, including political, economic, social, technological, legal and environmental factors helps to prepare to mitigate the associated negative effects and realise the potential positive effects.

Having a formal system for managing environmental risks is a requirement of various rating and certification schemes, for example ISO14001.

Responsibilities & Interests

The table below summarises the key activities associated with understanding and defining the wider risk context, and highlights where asset managers, property managers and facilities managers are likely to have a responsibility or specific interest.

- AM - Asset Manager

- PM - Property Manager

- FM - Facilities Manager

Step 1: Understand a PESTLE analysis

Stakeholder:

Step 2: Facilitate a horizon scanning workshop

Stakeholder:

Step 3: Add wider-context outputs to environmental risk registers

Stakrholder:

How to

Intro

Usually, the environmental risk framework adopted for a property or portfolio will be specified by an asset manager, in alignment to a wider corporate risk framework. The process of understanding and defining the wider risk context is often co-ordinated by a property manager, with input from a facilities manager where required.

Understanding and defining the wider risk context generally considers the following steps:

Step 1: Understand a PESTLE analysis

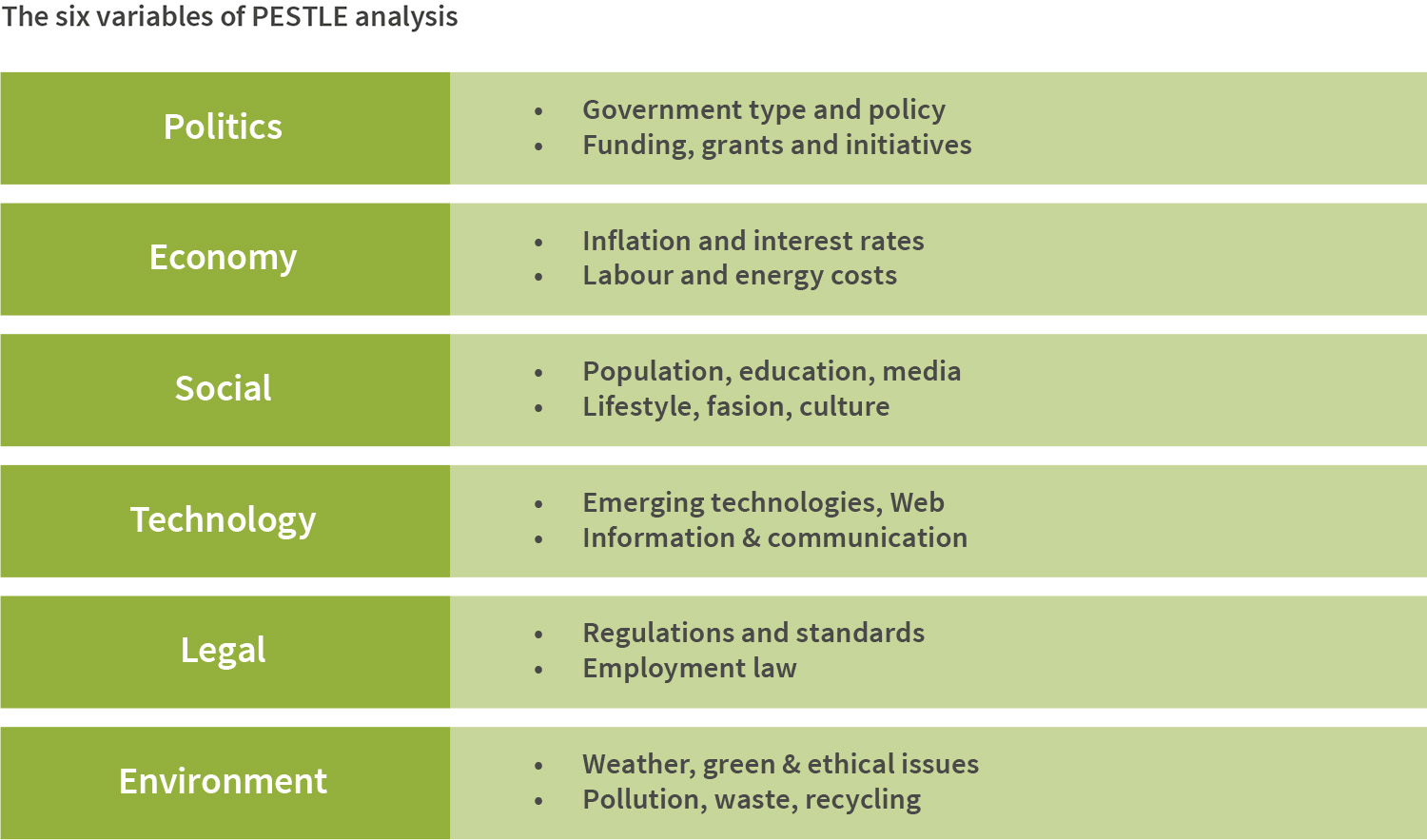

The risks associated with a company’s wider context is often undertaken through a PESTLE analysis. A PESTLE analysis involves consideration of the following six internal and external factors:

Political: Political related risks may relate to, for example:

- Trade restrictions impacting the movement and price of goods. For example, BREXIT limiting the availability and price of certain construction materials.

- Wider political unrest affecting production and supply. For example, regional instability affecting oil supply.

Economic: Economic related risks may relate to, for example:

- Upturns or downturns in the economic cycle resulting in prices for environmental commodities such as oil or insulation materials increasing or falling.

- Economic pressures influence budget availability, which may, in turn, provide leverage for resource efficiency activities, or may de-prioritise environmental activities which are not legally or financial driven.

Social: Social related risks may relate to, for example:

- Changes in social trends, education or consumer preferences. For example:

- A reduction in office occupancy during the COVID-19 pandemic impacting utilities consumption.

- An increase in the number of engineering graduates with an interest in renewable technologies enabling more affordable progress towards low carbon energy take-up.

Technological: Technology related risks may relate to, for example:

- A shift in technology supported by its increased availability through production increase and cost decrease. For example:

- The reduction in cost associated with LED lighting systems.

- The transition to elective vehicles.

Legal: Legal related risks may relate to, for example:

- Policy developments at the global, national or local level that may affect a company. For example:

- Development of government policy positions, globally, relating to net-zero.

- The emergence of increasingly stringent environmental criteria within building regulations.

Environmental: Environmental related risks may relate to, for example:

- Limitations in the natural environment’s ability to assimilate pollution or accommodate demand for natural resources. For example:

- Ozone depletion resulting in constraints on the use of ozone depleting gases.

- Restrictions on the use of timber from non-sustainable certified sources.

Step 2: Facilitate a horizon scanning workshop

The process to undertake a PESTLE analysis usually involves a facilitated ‘horizon-scanning’ workshop which can be used to consider the influence of an organisation’s wider context.

Tips to consider when preparing a PESTLE workshop include:

- Investigate previous PESTLE projects.

- Establish who in your organisation has relevant experience and knowledge.

- Decide who will facilitate the analysis.

- Arrange the workshop – who will attend?

- Decide whether to have one large, single group or to break into smaller groups or pairs.

- Provide a template – and give examples to get people started.

- Don’t get bogged down in the detail – or the ‘so what?’

- Be comfortable that issues may fit into more than one heading.

- Review the issues identified – and remove duplication.

- Plan your risk rating method in advance - keep it simple, and consistent with the rating method used for rating environmental aspects and impacts.

A horizon-scanning workshop would normally involve individuals from a range of functions, who are able to provide an insight into future trends including, for example:

- Human resources.

- Finance.

- Information Technology.

- Operations.

- Risk.

- Health, Safety, Environment and E.S.G.

A horizon scanning workshop would typically involve participants:

- Contributing to a discussion to identify PESTLE issues.

- Considering the risk and opportunities associated with these issues.

- Proposing actions to control associated risks.

A PESTLE workshop should also include the rating of the risks identified by the participants. This rating should follow as established risk rating method.

Examples of the discussion flow in a horizon-scanning workshop include:

Step 3: Add wider-context outputs to environmental risk registers

The significant risks identified during the PESTLE workshop should be fed into the relevant environmental risk register.

Given the more strategic nature of risks associated with the wider context, the control of these risks is usually at the company or portfolio level.

The ongoing review of PESTLE outputs should be undertaken by individuals with risk responsibility. Outcomes should be considered for inclusion in the wider risk governance framework operated at a company or portfolio level.

Related Guidance Notes

The following Guidance Notes contain related information:

- GN1.2: An environmental compliance register

- GN1.3: Environmental aspects and impacts

- GN1.4: The wider risk context

- GN1.5: Environmental risk control and assurance

- GN2.3: Sustainability reporting initiatives