GN7.2: Electric vehicle charging facilities

Guidance Note purpose

The purpose of this Guidance Note is to inform asset managers, property managers and facilities managers about the provision of electric vehicle (EV) charging, focusing on-site assessment, supplier selection and funding.

Context

Electric vehicles

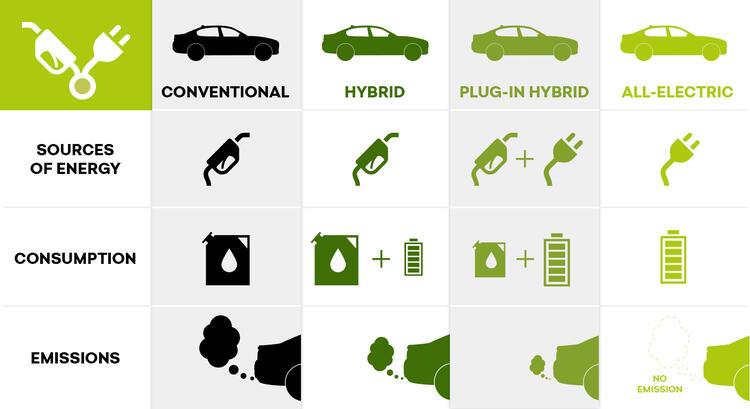

All electric vehicles have a battery, which is utilised for power some, or all, of the time. In this Guidance Note, electric vehicle refers to the following three types.

Hybrids: Hybrid electric vehicles have a battery which is recharged whilst driving, and therefore does not need to plug into a charge point to recharge. The range in electric mode is typically low due to the small size of the battery.

Plug-in hybrids: Plug-in hybrid electric vehicles have a battery which must be plugged into a charge point to recharge. They also have a fuel tank and can switch to running on conventional where necessary. The battery is typically bigger and has a longer zero emission range than a Hybrid electric vehicle.

All electrics: All electric vehicles must be plugged into a charge point to recharge. There is no option to switch to conventional fuel. As the battery is larger than plug-in hybrids, all electrics generally have a longer battery range.

Types of electric vehicle

Electric vehicle charting provision

Electric vehicle charging provision is a service delivered within the operational boundary of a property. This allows Electric vehicle drivers, for example employees, customers or business partners, to charge their plug-in vehicles from a site’s power supply via a dedicated socket and cable.

Electric vehicle charging provision involves three main stages:

- Assessing the number and types of vehicles likely to utilise the service, alongside the required charging speed, the supporting power network capacity and the site’s physical and operational characteristics.

- Identifying the appropriate commercial partners to deliver your electric vehicle charge provision requirements.

- Deciding the preferred funding model and charging arrangements to meet your charging provision requirements.

Importance

The shift towards lower carbon transportation is a central component of the approach taken by government and companies towards zero-carbon. The combination of emerging legislation, alongside changing customer expectations and business operating models, is increasing demand for electric vehicles.

Legislation and policy developments

The UK government has introduced legislation banning the sale of new petrol and diesel cars from 2030 onwards to encourage electric vehicle use. This was supported by a number of government policy positions, published in 2019, setting out requirements for electric vehicle charging provision in properties.

Changing demand

The availability of a wider selection of electric vehicle models, more reliable charging networks and advancing battery technology, is likely to see the continuation of the increasing trend in demand for electric vehicle charging provision. Next Green Car provides the latest statistics on the uptake of electric vehicles and the installation of electric vehicles charge points.

As battery technology improves for larger vehicles, increased charging provision will support low-emission freight and logistics. Similarly, as networks of micro-mobility services, for example e-bikes and e-scooters, develop, consideration on how best to support the uptake of this wider mobility market.

Other drivers

There are a number of other drivers for considering electric vehicle charging, for example:

- Electric vehicle charging infrastructure presents an additional revenue stream opportunity to supplement traditional rental income.

- Installing electric vehicle charging infrastructure early enables additional power capacity on site and from the local network to be secured before there is saturation in the local area.

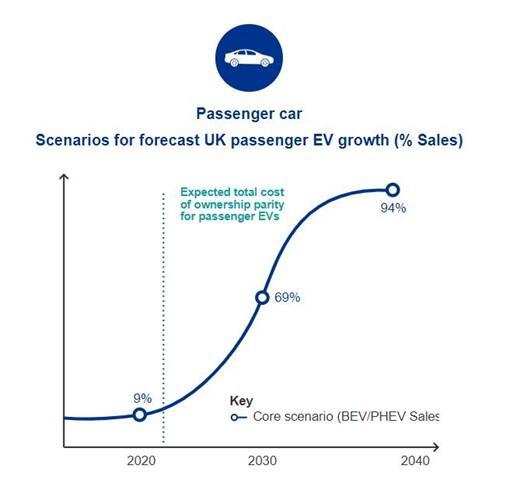

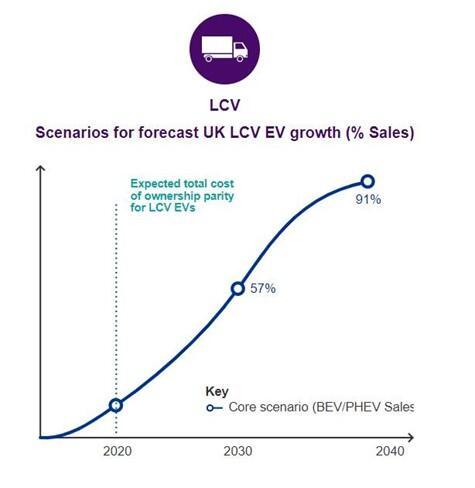

Anticipated growth for electric vehicle cars and vans

KPMG; Mobility 2030: Transforming the mobility landscape (Sep’19)

Responsibilities & Interests

The table below summarises the key activities associated with electric vehicle charging provision, and highlights where asset managers, property managers and facilities managers are likely to have a responsibility or specific interest.

- AM - Asset Manager

- PM - Property Manager

- FM - Facilities Manager

Step 1: Site assessment

Stakeholder:

Step 2: Review electric vehicle charging provision proposal and select commercial partners

Stakeholder:

Step 3: Consider funding model and other issues

Stakeholder:

How to

Step 1: Site Assessment

It is important that a site’s characteristics, along with the associated opportunities and constraints, are clearly understood when planning electric vehicle charging provision. This should involve an initial review of a site, followed by a more detailed site survey and proposal.

Site Review

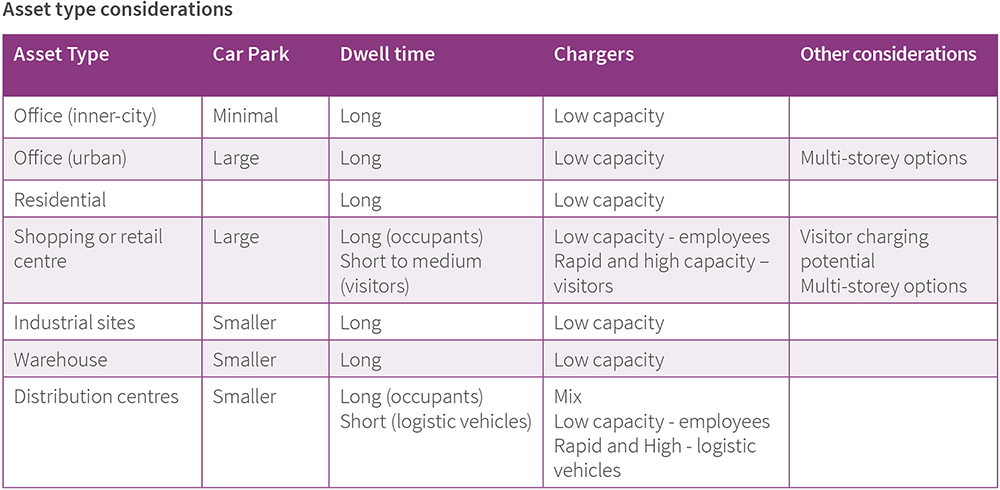

The following elements should be considered to determine the appropriate scale and capacity of electric vehicle charging provision for a property in the short and longer term:

- The current density of electric vehicle vehicles registered in the local area using the DVLA’s region and postcode district datasets.

- The typical dwell time on site to determine which sizes of chargers are required.

- Other chargers and charging speeds that are available in the area. For example, Zapmap lists all chargers across the country.

- The amount and location of spare power capacity on site which will determine the number of charges that can be accommodated and where they can be positioned.

- The local power network capacity to accommodate additional power provision to the site should the onsite power capacity be insufficient to meet the requirement.

What is dwell time

Dwell time is the amount of time a building user spends on site, and is a key actor for assessing the right capacity of individual charging points:

- Sites with a longer dwell time that need to cater for multiple drivers: 7kW - 22kW capacity fast charging facilities are likely to be most appropriate. For example, residential, workplace, shopping centres, retail parks.

- Sites with a short dwell time that need to cater for a high turnover and fewer drivers: 50kW+ rapid charging are likely to be most appropriate. For example, industrial distribution sites, en-route sites and motorway sites.

Dwell time considerations

- Short dwell time: Rapid charger – 50kWh+ capacity. May require sub-station

- Medium dwell time: High charger – 22kW capacity

- Long dwell time: Low charger – 7kW capacity

Site survey and proposal

Technical advice from a competent practitioner, for example a specialist consultant or electric vehicle charge point provider, will be required as part of a detailed site survey. The site survey should inform the development of a proposal to install electric vehicle charging facility, and may include the following:

- Proposed site redevelopment/refurbishment plans.

- Service drawings.

- Access to all power supplies on-site with up-to-date circuit schedules.

- Any power shutdown requirements that will lead to out of hours work.

- Number and type of parking spaces on site.

- Planned or potential installation of on-site renewable facilities.

Step 2: Review electric vehicle charging provision proposal and select commercial partners

During the review of a proposal for electric vehicle charging provision, and the selection of a preferred supplier, it may be helpful to consider the following questions relating to charging units, management and monitoring, and maintenance and warranty.

Charging unit

- Does the supplier offer charging options and speeds (i.e., fast charging, rapid charging, media charging) appropriate to the needs of different sites in the portfolio?

- Has the supplier included sufficient scope for future expansion (i.e. additional trenching)?

- What types of electric vehicles can the charging units accommodate?

- Are the charge points accessible to all electric vehicles drivers - allowing for quick and simple access via an app or card payment? Can access be restricted if necessary?

- Are the charging units modular and smart enabled, to remain up-to-date with technology advancements?

- Are the charging units agnostic or specific to a certain supplier, enabling the client to switch operator in the future?

- Does the provider have Independent Connection Providers and Independent Distribution Network Operator partners that will help to engage with the relevant Distribution Network Operators to bring in new connections?

- Which party is responsible for requesting new connections and owning associated supply?

- Can charging units be load managed with an Array Charging System, which will enable the site to scale cost effectively with future demand and optimize available power on site?

Management and Monitoring

- Does this system allow portfolio power usage to be reviewed?

- Can the charging units be managed centrally through one system?

- Can faults be detected remotely and proactively fixed?

- Does the client have visibility of all charging units and charge cycles?

- Can the charging units be integrated with on-site systems?

- Can the client track how electric charging is making the site(s) more sustainable (CO2 saved)?

- Can data be used to better understand unit utilization and when it is time to scale?

- Can the client apply a charging tariff through the management system?

- Can the client apply dynamic and complex pricing models across separate units and sites?

- What physical and software security features does the infrastructure and system have?

- Which party owns the data?

Warranty and Maintenance

- How many months/years does the unit(s) warranty cover?

- Is there an associated cost with this warranty?

- What are the supplier’s Service Level Agreements?

- What is the supplier’s terming once the warranty is finished?

- Can most maintenance issues be fixed remotely by the provider?

Step 3: Funding model

Funding sources

Government Funding

The Workplace Charging Scheme (WCS) provides a subsidy towards the purchase and installation cost of a new workplace charging station by up to 75% (capped at £350per socket). Businesses can claim for up to 40 charging stations (40 single socket or 20 double socket) under the scheme, which is managed by the Office for Low Emission Vehicles (OLEV).

Service Charge

The way in which occupier service charges take account of shared services may impact the extent to which electric vehicle charging provision can be charged to the individual user. This should be considered at the leasing stage, see the BBP Green Lease Toolkit.

Benefit in Kind

The provision of electricity for employees to charge private cars is classed as a Benefit-in-Kind, i.e., a non-financial benefit which employees receive from their employer in addition to wage or salary.

Benefits in kind are considered as income by HMRC and should be included within an individual’s annual tax return. While at present, charging private electric vehicle charging at work is tax exempt, this may change in the future as electric vehicles become more common-place.

Funding models

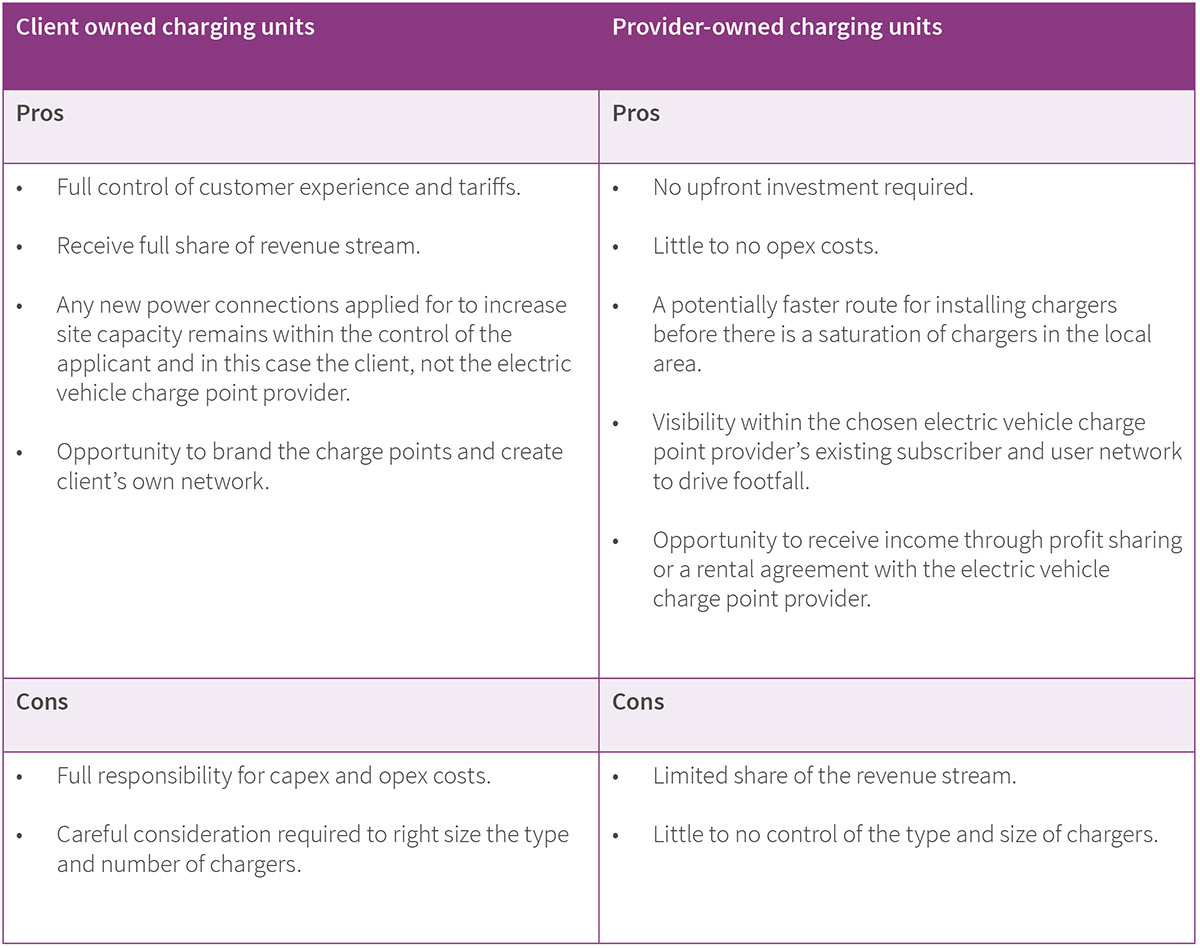

It is important to evaluate alternative funding models for equipment purchase, installation and operation. Most service providers offer outright purchase and/or fully funded models which have associated varying degrees of control.

Client-owned

The option to directly purchase charging units and cover the operational costs associated with electric charging provision provides greater control for the client. However, an agreement or partnership can still be formed with an electric vehicle charge point operator to provide supporting services during the scheme’s operation.

Charge provider-owned

The option for electric vehicle charge point providers to provide a fully funded options, which usually covers surveys, installation, unit costs, maintenance and any future upgrades for the duration of the agreement, provides limited control for the client. However, visibility of utilisation and ability to receive a share of information can still be retained as part of the scheme.

Pros and cons of client-owned and provider-owned charging units

Step 4: Other considerations

The following factors should also be taken into account when considering electric charging provisions.

User experience

It is important to consider the all-round experience of those using electric vehicle charging facilities. This may include:

Checking that charge points are operating safely and are tested and inspected regularly.

Considering how the design features, for example, the height of the charge point and the parking space size, allow users with all accessibility requirements to operate the charger.

Locating charge points in a visibility area and providing signage for easy wayfinding.

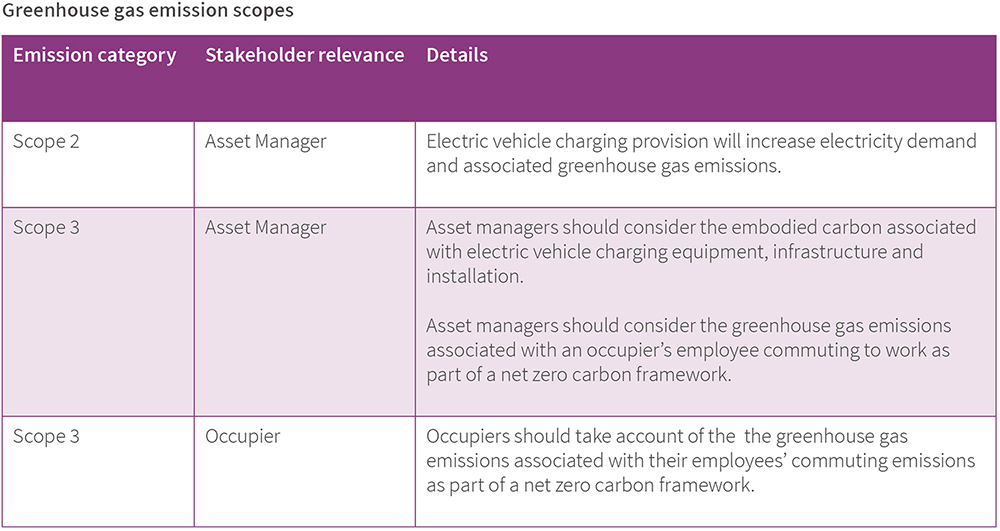

Net zero carbon

Installing electric vehicles charging is likely to increase a site’s electricity consumption. Procuring electricity via a high-quality green tariff or renewable source offers the potential to reduce operational greenhouse gas emissions.

Related Guidance Notes

The following Guidance Notes contain related information:

- GN2.1: An asset register

- GN2.2: Automating property level data

- GN4.7: Setting energy targets

- GN4.9: Energy efficiency opportunities

- GN4.10 Maintaining sustainable energy and water assets

- GN4.11: Procuring renewable energy

- GN7.1: Sustainable transport opportunities

- GN11.1: Building User Guide

- GN11.2: Engaging Occupiers

- GN11.3: Service charge considerations

- GN13.1: Assessing stakeholder requirements

Additional Resources

- BBP Green Lease Toolkit

- DVLA: Data on ultra-low emission vehicle licensing

- Next Green Car: Electric vehicle market statistics

- Pod-point: Electric vehicle guides and information

- Pod-point: EV charging for Property Managers

- Pod-point: Electric vehicle charging and personal taxation

- UK Government: Electric vehicle charging in residential and non-residential buildings

- Zapmap: Electric vehicle charging point locations