Case Studies

To share learnings from the approaches, challenges and achievements of our members with the wider industry, we develop case studies showcasing best-practice or innovative projects our members have undertaken.

The Big Energy Race: Powering Change Across London’s Workspaces

The Big Energy Race: Powering Change Across London’s Workspaces

All Case Studies

-

Orchard Street Investment Management Transforms Energy Performance Across Industrial Portfolio

Tue 12 Jul 2022

Improving existing building stock is critical to delivering a net zero carbon future for the UK. To accelerate progress towards a net zero portfolio, Orchard Street Investment Management has successfully upgraded an additional 35 industrial units to Energy Performance Certificate (EPC) ratings of B or above, largely through refurbishment, in just two and a half years. Nine units achieved the highest rating A+, predicted to be operationally carbon neutral for regulated building energy. Plans are in place for remaining assets lower than EPC D to be raised to B or above.

Topic: Energy/Carbon

Type: Case Studies

-

Derwent London Leads Occupier Engagement for Climate Action

Wed 29 Jun 2022

To accelerate progress towards net zero carbon, Derwent London carried out its first Net Zero Carbon Occupier Survey. Completed by 49% of occupiers (based on estimated rental value), this revealed valuable insights into the challenges that occupiers face in delivering carbon reductions and highlighted opportunities for greater collaboration. Derwent London is now engaging with occupiers to support them in sharing best practice, setting targets and benchmarking performance.

Topic: Occupier Engagement

Type: Case Studies

Member: Derwent London plc

-

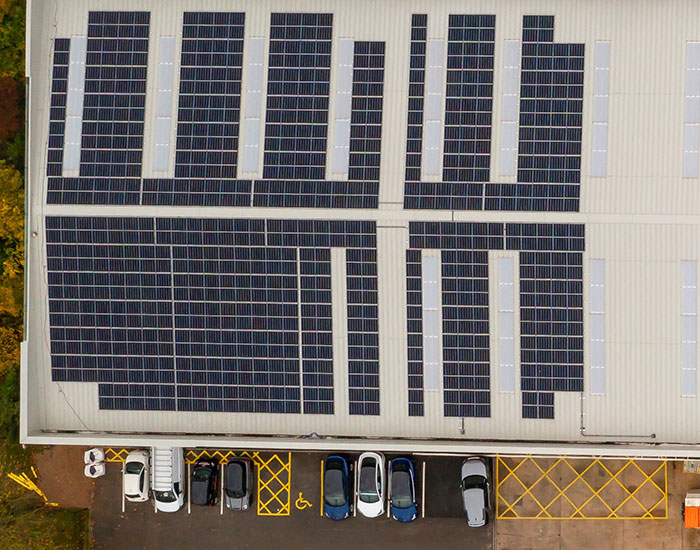

SEGRO Park Enfield Shows Bright Future for Wellness in Warehouses

Mon 27 Jun 2022

Wellbeing and sustainability innovations at SEGRO Park Enfield are creating the warehouse of the future. Smart building technology will empower occupiers to manage spaces that prioritise employee wellbeing and energy efficiency. Extensive glazing provides more natural daylight and opens up views. LED lighting and photovoltaic panels are incorporated to reduce carbon emissions. A fitness trail, riverside footpath and facilities for cyclists encourage active lifestyles.

Topic: Market Transformation

Type: Case Studies

Member: SEGRO

-

The Crown Estate’s Rushden Lakes Commended for Green Travel

Thu 23 Jun 2022

Topic: Property Management

Type: Case Studies

-

Small Steps Make a Big Biodiversity Impact on Industrial Park

Thu 26 May 2022

At Erdington Industrial Park near Birmingham, Federated Hermes and JLL have proved the power of small-scale ecology upgrades on existing assets to enhance biodiversity and bring benefits to occupiers.

Topic: Biodiversity

Type: Case Studies

-

Lendlease and Crate to Plate Lead Urban Farming Revolution

Wed 09 Mar 2022

When Lendlease partnered with innovative urban farming venture Crate to Plate at Elephant Park, it proved so successful that the partnership is now expanding to International Quarter London, with plans for additional sites. Collaborating with brands that are championing sustainability, tackling climate change and helping build healthier communities supports Lendlease’s wider sustainability commitments.

Topic: Market Transformation

Type: Case Studies

-

Legal & General Outperforms Industry Targets on Lifecycle Carbon at North Quay House

Wed 16 Feb 2022

North Quay House in Bristol is the latest refurbishment by Legal & General Investment Management (LGIM) Real Assets to undergo a detailed lifecycle carbon assessment. This revealed that the project is on track to achieve embodied emissions well below industry targets, evidencing the carbon benefit of retaining and renewing existing structures rather than building new. Planned upgrades to the building fabric and systems will also substantially reduce operational emissions, accelerating progress to net zero carbon.

Topic: Retrofit & Refurbishment

Type: Case Studies

Member: Legal & General IM Real Assets

-

GPE Accelerates Progress to Net Zero Through Industry-Leading Internal Carbon Price

Wed 12 Jan 2022

GPE’s internal carbon price of £95 per tonne, which originally launched in 2020, is transforming behaviour and driving innovation in the race to net zero. Covering both embodied carbon and operational emissions, this internal carbon price goes further than others in the UK real estate sector. All contributions feed into a Decarbonisation Fund, created to support the deep retrofitting of the existing portfolio, further accelerating the transition to net zero and building in climate resilience for the future of London.

Topic: Energy/Carbon

Type: Case Studies

Member: GPE